Imagine you freeze your customer base for a year — no upsells, no add-ons. Gross Revenue Retention tells you how much of that original revenue you’d actually keep.If that number is low, it means your foundation is shaky — customers are slipping away, and all the flashy growth on top can’t hide the cracks.

Most B2B SaaS leaders proudly present Gross Revenue Retention (GRR) as proof of stability. But what if that 95% GRR is hiding a churn crisis? Early-tenure customers who leave within the first year don’t show up in GRR — and that’s where the real danger lies.

Check out this story of Nimbus SaaS, where a boardroom conversation uncovers how GRR can mislead, why First-Year Retention (FYR) matters, and what happens when growth looks efficient on paper but leaks value in reality.

The Boardroom Scene

Nimbus SaaS, a $20M ARR company, had gathered its leadership for the quarterly board review.

- Michael (CEO) clicked through his deck with a smile.

- Sarah (Head of Customer Success) looked restless.

- Robert (Board Member) tapped his pen, waiting to challenge assumptions

And other leaders from Product, Marketing, and Engineering.

If you’ve ever been in a leadership meeting, this setup probably sounds familiar. Big numbers on slides, quiet concerns around the table. Let’s see how this one unfolds.

The Headline Numbers

Michael (CEO) began confidently: “Our GRR is 95%, and Net Revenue Retention is 107%. We closed 100 new customers this year at $10K ACV each — $1M in new ARR.” The board nodded. Nimbus SaaS looked stable.

On the surface, nothing to worry about. But do you see the problem yet?

The Blind Spot Emerges

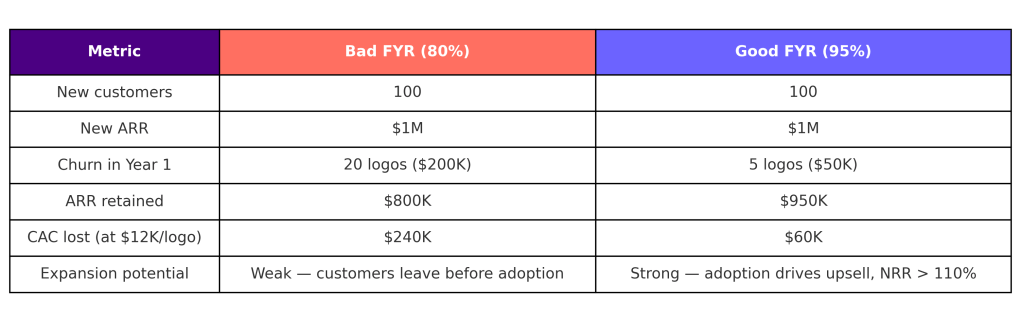

Sarah (Customer Success) broke the silence:“That’s the GRR story. But 20 of those 100 new customers have already churned within their first year. That’s $200K in lost ARR and $240K unrecovered CAC. Our First-Year Retention (FYR) is just 80%.” The room went quiet.

Now you see it. GRR makes the board feel safe while the bucket is leaking at the bottom.

Why These Customers Leave Early

Sarah (Customer Success) continues:

- Sales overcommitment → promises stretched beyond reality.

- Weak contracts → easy exits with no minimum terms.

- Onboarding undervalued → given away free, so customers don’t invest effort.

- Slow time-to-value → product adoption drops after week six.

Sound familiar? If you’ve worked in SaaS, you’ve seen this play before.

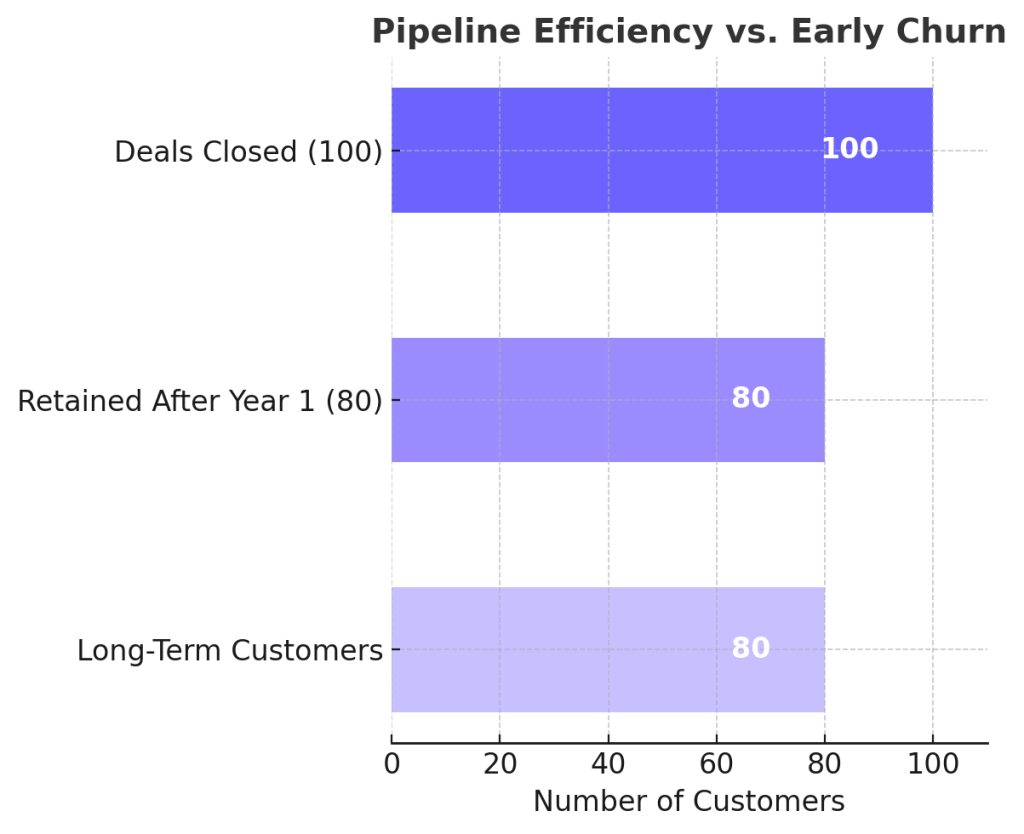

The “Pipeline Efficiency” Illusion

Michael (CEO) defended Sales: “We still closed $1M ARR. That’s growth.”

Sarah countered: “Only $800K survived Year 1. We’re scaling inefficiency. Each churned customer cost $12K in CAC — $240K wasted.”

See how easy it is for revenue slides to hide inefficiency? This is why boards get blindsided.

The Pipeline Efficiency Leak

100 deals closed doesn’t mean 100 customers retained. GRR hides the leak — only 80 make it past the first year.

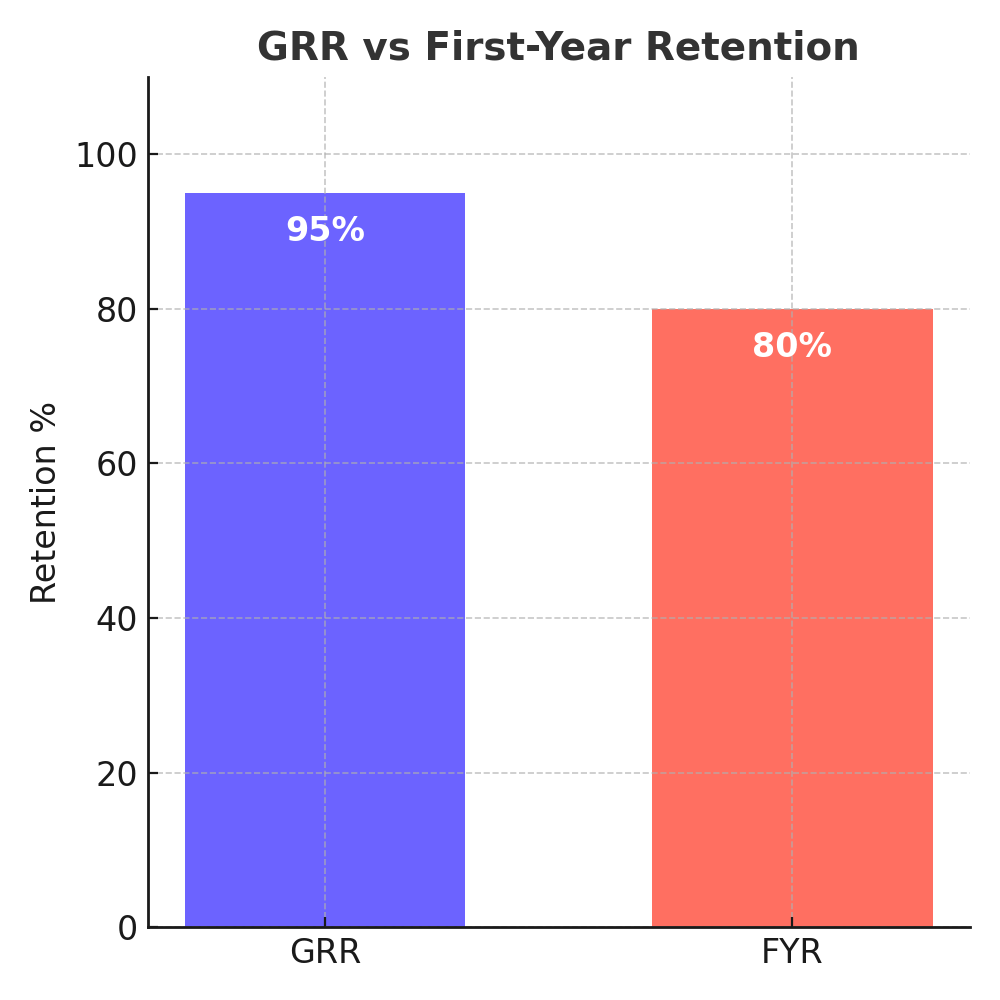

GRR vs FYR — The Metrics Contrast

GRR looks flattering at 95%. FYR at 80% shows the painful truth. Which one would you rather bet your company’s future on?

Two Scenarios: Bad vs Good FYR

Notice how the same sales effort produces two totally different outcomes, depending on FYR? This is why GRR alone is myopic.

The Board Calls It Out

Robert (Board):

“We cannot keep celebrating GRR in isolation. If 20% of new customers never survive Year 1, then every $1M booked is really $800K or less. That’s not scale — that’s waste.”

Finally, someone says it out loud. But how many of your board meetings gloss over this exact issue?

The CEO’s Realization

Michael nodded: “From now on, we’ll report GRR and FYR side by side. We’ll tighten contracting, make onboarding a paid, value-driven engagement, and focus on accelerating time-to-value.”

A CEO admitting that GRR isn’t enough. Refreshing, isn’t it?

Closing Reflection

GRR is important, but incomplete. Without FYR, you don’t know if customers are actually finding value.

- GRR shows how revenue behaves.

- FYR shows if customers survive long enough to grow.

Now ask yourself: are you still hiding behind GRR in your own boardroom?